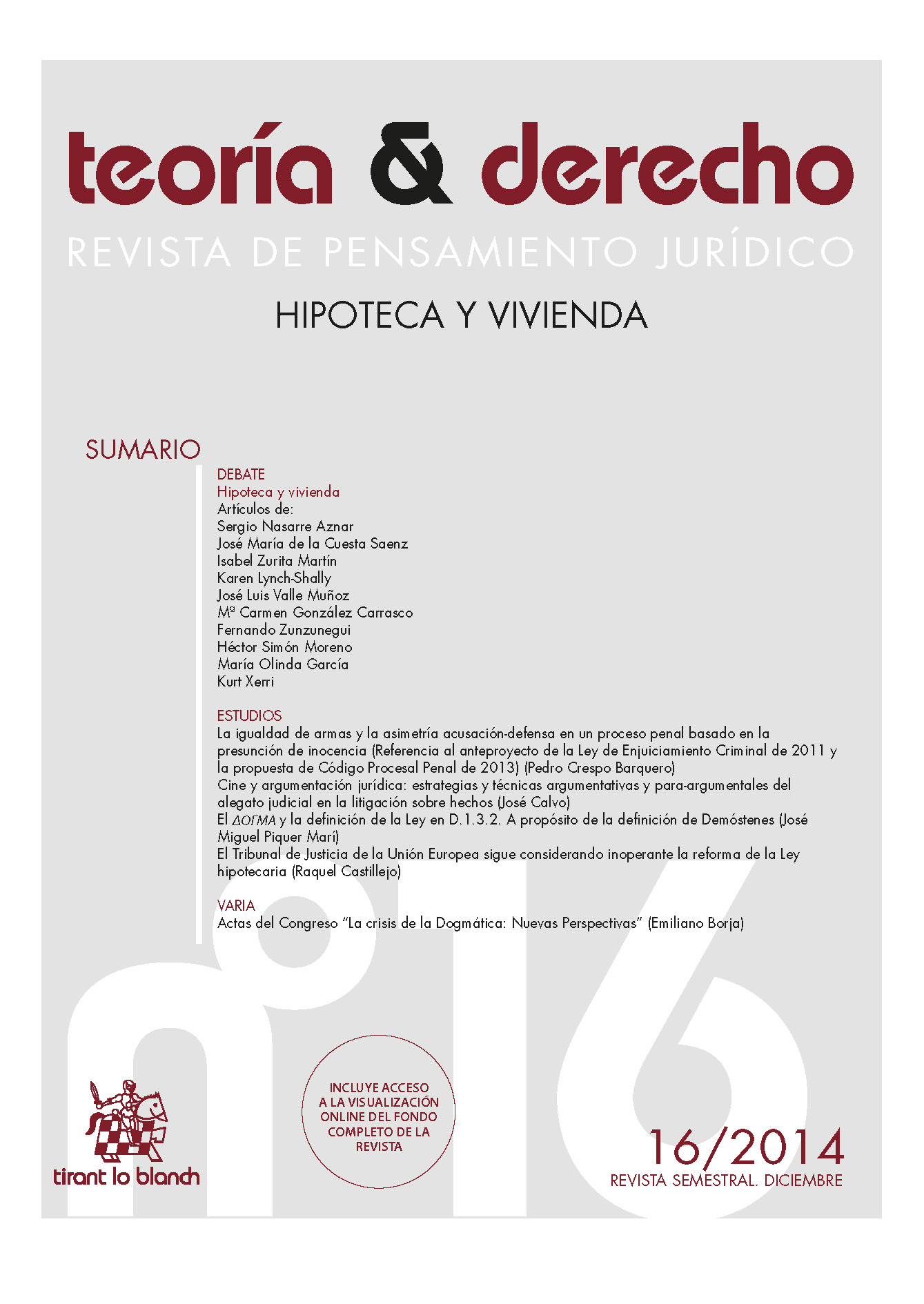

“FLOOR” CLAUSE. NULLITY FOR LACK OF TRANSPARENCY AND PROBLEMS OF LEGAL CERTAINTY

Keywords:

Variable interest rate in mortgage loans, Clause limiting the floor and ceiling of interest, Transparency requirements, Nullity, Legal certaintyAbstract

Once published the STS (1st Chamber) of 9 May 2013, the expectations of the consumer associations and those affected have become reduced. The ground clauses are permissible if its transparency allows the consumer to identify the clause as defining the main object of the contract and know the actual distribution of risks of varying rates. But, is it possible to analyze the lack of transparency at the initiative of the judge? Is it respectful with the juridical safety the nullity for lack of transparency of a clause obedient to the regulation on bank transparency? Can this requirement be the basis for collective action? The present article answers negatively to these questions and thinks that the affirmative response on the part of the doctrine of the Supreme Court has provoked a juridical undesirable insecurity for the credit system