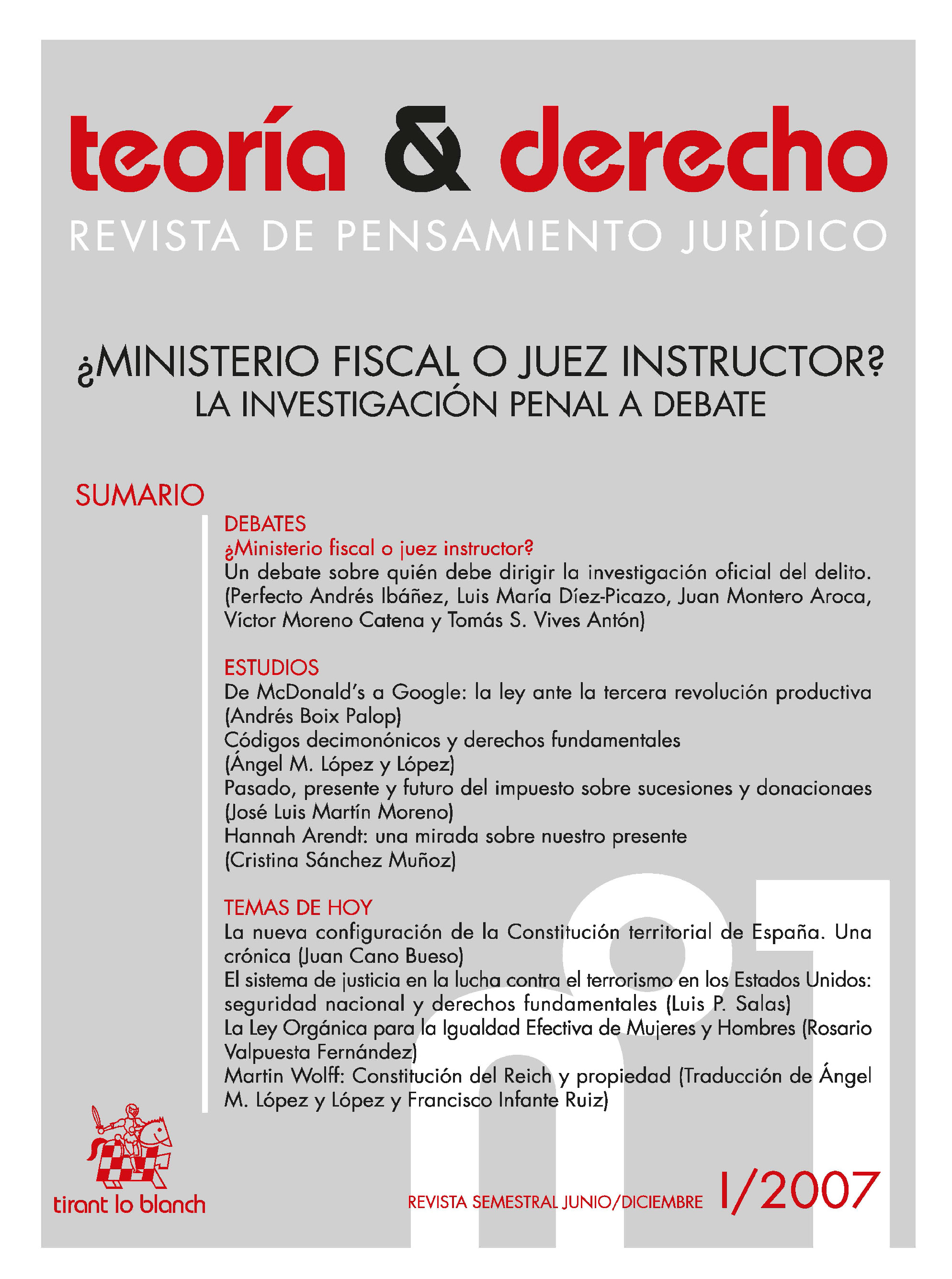

PASADO, PRESENTE Y FUTURO DEL IMPUESTO SOBRE SUCESIONES Y DONACIONES

Keywords:

INHERITANCE TAX PRECEDENTS, REFORM, FAMILY, KINSHIP, FISCAL BENEFITSAbstract

The regulation of the inheritance tax turns out to be historically tied to the concrete regulatory discipline of the property and the inheritance and only it can be understood under the prism of other civil institutions as the family and marriage. Respecting the constitutional right of the inheritance and the specifically tributary beginning, this tax admits diverse possibilities of configuration. But in a State where is postulated the social function of the property, the redistribution of wealth and the duty of all to contribute to the maintenance of public charges, there would not be understood the abolition that his detractors propose. The future of this tax demands his reform, to adapt to the social reality of our time, which it includes to increase significantly the exempt minimums for spouses, persons with analogous relation, ascendancies and descendants. The state legislator, holder of this tax, must need also the budgets of the reductions for transmission of the company, and to design several articles of the tax that need a reform, assuring a few basic positions of equality of the citizens of any Autonomous Community in the taxation of the inheritances and the gifts